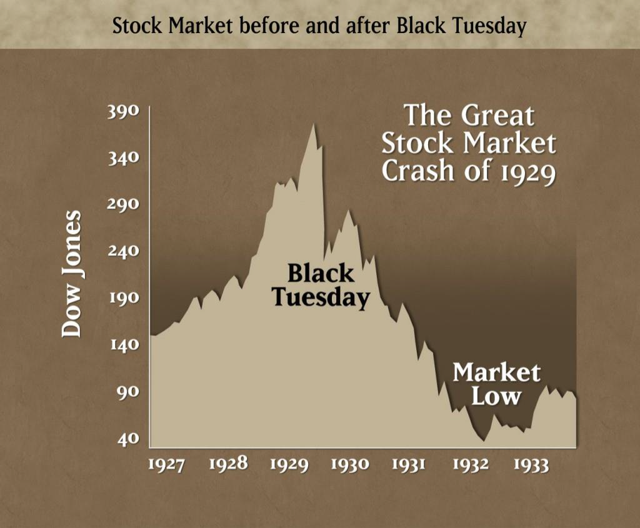

So many market cliches have been used to describe markets over the years. These include Goldlilocks, the Fed Put, irrational exuberance, don't fight the FED, don't fight the tape, etc. The aptest phrase for today's markets is the famous quote from economist Irving Fisher in October 1929 right before the Great Depression of the 1930s set in:

"Stocks have reached what looks like a permanently high plateau"

Source: Market Cycles Chart - New Trader U

Of course, central banks have a plethora of unconventional monetary policy tools at their disposal to avert major crises these days, but valuations are quite stretched.